Flexible Dental Plans Made Easy with Multi-Lender Patient Financing

Increase Conversions and Drive Financial Inclusivity for Your Patients

Seamless Full Spectrum Patient Financing

Patient-Driven

Versatile’s streamlined self-service process guides patients through multiple financing options that are tailored to fit their individual needs and budget, resulting in improved approval rates and elevated patient satisfaction.

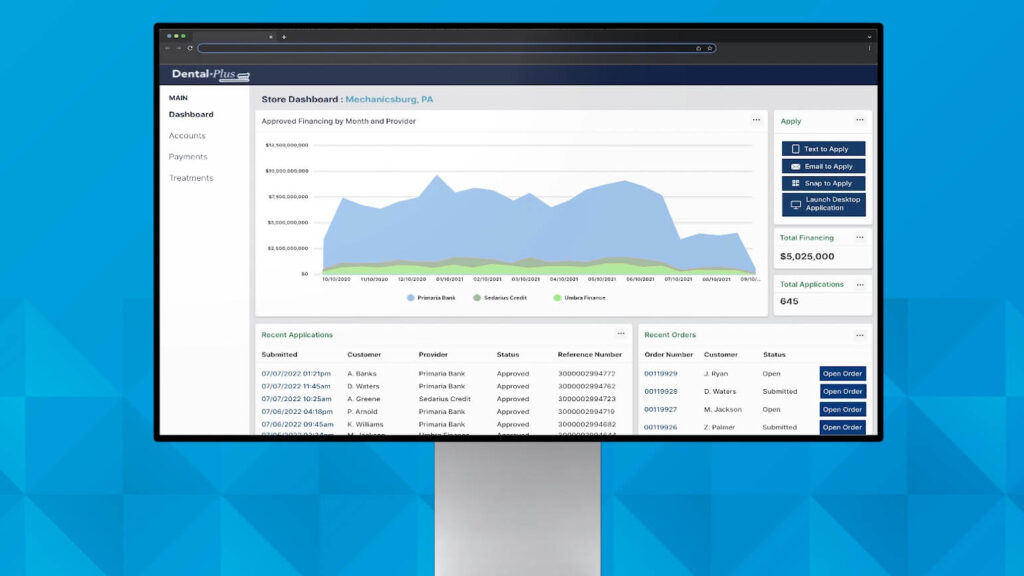

Streamlined Platform

Our platform provides practices with a single, easy-to-use portal for applications and transaction processing and powerful analytics tools to help you understand the performance of your financing program

Power of Multiple Lending Partners

Practices have access to a full spectrum cascade, with full prequalification from prime, near prime, to sub-prime options in a seamless experience that quickly connects patients with the options that fit their needs — made possible by Versatile’s network of lending partners.

Fast Path to Approval

Offer multiple flexible options through a single, user-friendly application, guiding patients swiftly to informed financing decisions while reducing hard credit checks with tool like instant prequalification.

Multi-device application launching

Versatile’s platform is compatible with any modern tablet with camera access and can be run on unlimited devices in-practice. A free iPad (1 per office) is provided to participating practices.

Patient Mobile Devices

The applications are also available on consumer mobile devices with participating lenders*. Applications can be launched on consumer mobile devices by text message, email, or by scanning a QR code.

Optimize The Patient Financing Experience

Dynamic Routing & Embedded Logic

Versatile’s platform can intelligently route applications to high-line credit lines with limits up to $75,000, tailored to match the specific requirements of the procedure. Prequalification ensures patients are connected with financing options that align with their credit profiles.

Real-Time Results

Practice staff receive real-time application results, allowing them to follow the patient throughout the process.

Analytics and Reporting

Practices have access to a real-time analytics, customizable dashboards, and custom reporting to gain visibility into the performance of their financing program.

Compliance, Efficiency, and Scalability

Versatile ensures secure, compliant application while ensuring efficient end-to-end transaction management, from application to checkout. The portal facilitates swift onboarding and scaling, accommodating the dynamic, growing needs of practices.

Versatile Credit Sign Up or a Demo

* Required

Interested in Learning More?

Reach out to Versatile Credit today for a demo by filling out the form!

With Versatile Credit, practices can offer a comprehensive range of patient financing plans without getting overwhelmed by financing processes while attracting more patients and growing their practice.

Interested in Learning More?

Reach out to Versatile Credit today for a demo by filling out the form!

Our Lending Partners

Prime Lenders

Near Prime Lenders

Sub Prime Lenders

Versatile Credit Resource Center

Driving Access to Care: Ed O’Donnell on Technology and Compliance

In the latest video in the Driving Access to Care Thought Leadership Series, Versatile Credit CEO Ed O’Donnell discusses the role of technology in driving access to care through patient financing. With a focus on compliance and a patient-first approach, Versatile is helping practices streamline their financing processes and provide their patients with the best options for affordable care.

ADSO Summit Panel: Unlocking the Power of Patient Financing, Maximizing Access to Care

Throughout the discussion, the panelists spoke about the crucial role that technology, a comprehensive selection of financing options, and strong partnerships play in delivering a seamless, frictionless, and patient-centric financing experience.

ADSO Summit Panel: Enabling Access to Care, The Importance of Patient Financing

In a recent panel at The Association of Dental Support Organizations (ADSO) Summit 2023, Versatile Credit’s CEO Ed O’Donnell provided insight into one of the biggest challenges that dental providers face today: patient financing.

Versatile Credit Resource Center

Driving Access to Care: Ed O’Donnell on Technology and Compliance

In the latest video in the Driving Access to Care Thought Leadership Series, Versatile Credit CEO Ed O’Donnell discusses the role of technology in driving access to care through patient financing. With a focus on compliance and a patient-first approach, Versatile is helping practices streamline their financing processes and provide their patients with the best options for affordable care.

ADSO Summit Panel: Unlocking the Power of Patient Financing, Maximizing Access to Care

Throughout the discussion, the panelists spoke about the crucial role that technology, a comprehensive selection of financing options, and strong partnerships play in delivering a seamless, frictionless, and patient-centric financing experience.

ADSO Summit Panel: Enabling Access to Care, The Importance of Patient Financing

In a recent panel at The Association of Dental Support Organizations (ADSO) Summit 2023, Versatile Credit’s CEO Ed O’Donnell provided insight into one of the biggest challenges that dental providers face today: patient financing.

CONTACT US

* required

RECOMMENDED FROM OUR [BLOG]

Many states throughout the country have issued “Stay at Home” orders in response to the COVID-19 outbreak, and as the vast majority of our fellow citizens comply, that has motivated forward thinking retailers to re-evaluate their in-store experiences and interactions between customers, employees, and their physical storefronts […]

Recent events have led to unexpected business interruptions for many retailers. Consumers are staying at home, driving traffic away from physical brick-and-mortar locations to eCommerce sites, where growth rates are already rising by nearly 52% this year, according to Quantum Metric. This has led retailers to explore options to provide consumers with consistent shopping experiences both in-store and online, as well as ways to ensure the business continuity of their financing programs […]

©2024 VERSATILE CREDIT | privacy policy

Anonymous tips or complaints? Click here